This time last year the 15-year fixed-rate mortgage was at 303. Home loans with shorter terms or adjustable rate structures tend to.

The Lowest Mortgage Rates In Nearly 50 Years Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Lowest Mortgage Rates In Nearly 50 Years Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What is the interest rate on a reverse mortgage.

Average home loan interest rate 2020. The average mortgage interest rate is 298 for a 30-year fixed mortgage influenced by the overall economy your credit score and loan type. The average rate for a 30-year fixed rate mortgage is currently 399 with actual offered rates ranging from 313 to 784. Thats why finding the best mortgage rate is so important.

The average APR on a 15-year fixed-rate mortgage fell 8 basis points to 2187 and the. You can use Bankrates home loan. The average rate on a conventional 30-year fixed-rate home loan is 365.

As of 24 July 2020 the prime interest rate stands at 7 the lowest in 5 decades. On Monday April 19th 2021 the average APR on a 30-year fixed-rate mortgage fell 8 basis points to 2862. And the home loan interest rate is the primary factor you should be looking at when comparing home loan packages.

In the month of October 2019 the average interest rate on a reverse mortgage was 4238 according to the statistics published by HUDgov. Securing a home loan is a significant step on the way to owning your dream home. Mortgage rates in 2020 have dropped due to the Federal Reserve lowering rates in response to COVID-19.

The new rate of home loans will start at 68 for a total loan of up to Rs30 lakh and for a loan amount of more than Rs30 lakh the rate of interest will be 695. At the current average rate youll pay 44626 per month in principal and interest for every 100000 you borrow. How can I check total interest payout for my home loan.

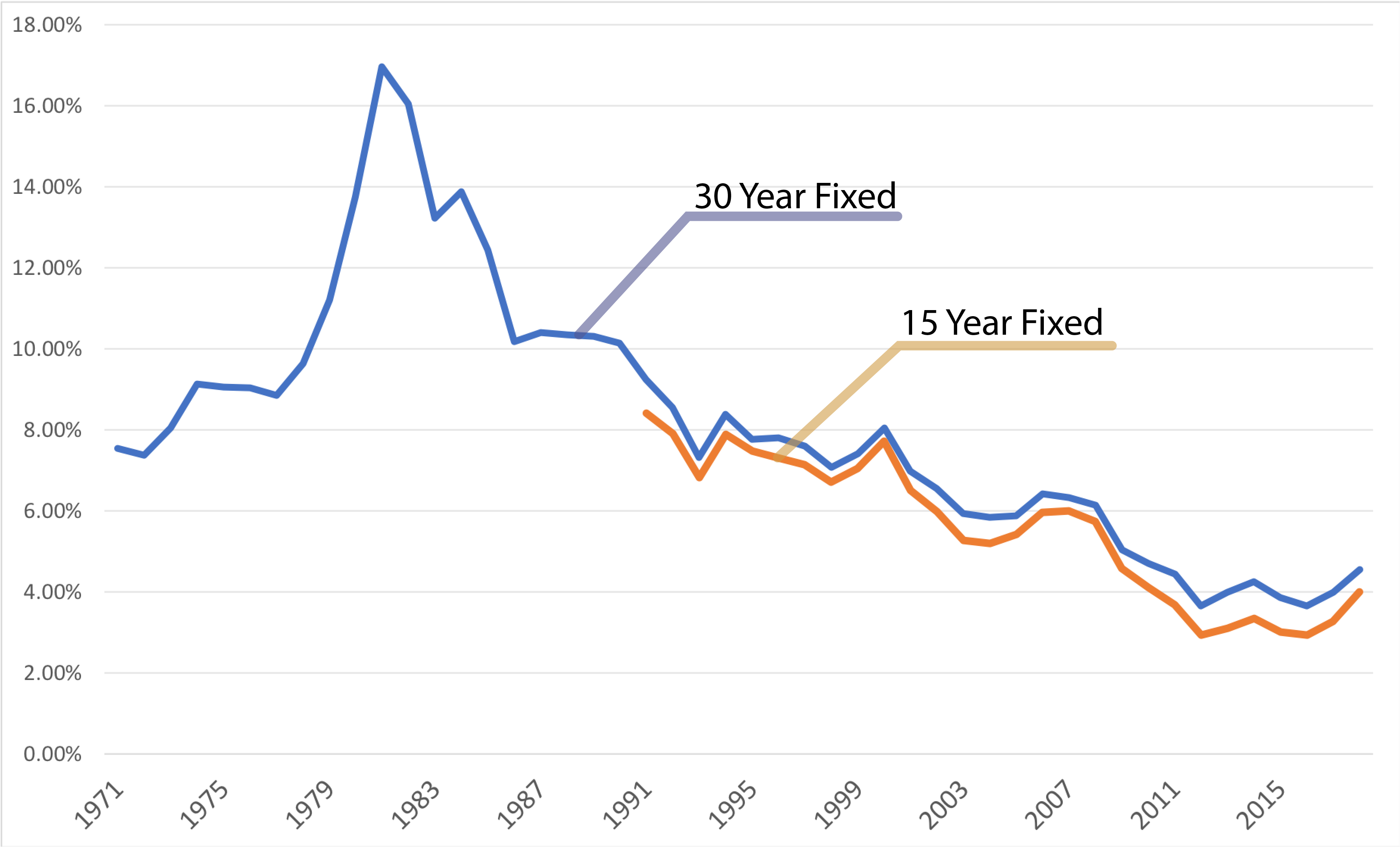

The average mortgage interest rate decreased for two of the three main loan types and dropped for the third 30-year fixed 318 to 313 15-year fixed 245 to 242 and 51 ARM 284 to 292. Thats 670 lower compared with last week. According to the press release the discount which is being offered of up to 30 bps will be dependent on the loan amount taken and the CIBIL score of the primary applicant.

However its important to note that reverse mortgage interest rates. The average interest rate on the 15-year fixed mortgage is 236 down 4 basis points from 24 over the last week. Their data reveals that 2264 was the lowest reverse mortgage interest rate during that time period and the highest was 6168.

As of this writing in November 2020 the average 30-year fixed mortgage rate with a 20 down payment had just hit fresh record lows at 272 according to Freddie Mac. The average 15-year fixed mortgage rate is 2410 with an APR of 2650. Two year variable mortgage rates fell from 203 percent in September to 194 percent in December but then increased further to 25 percent in March 2020.

Based on your creditworthiness you may be matched with up to five different lenders. This time last year the 15-year fixed-rate mortgage was at 314. Current mortgage rates have fallen slightly since this time last month.

The average 51 adjustable-rate mortgage ARM rate is 3200 with an APR of. The EMI for 20 lakhs loan at the latest home loan interest rate of 670 for the tenure of 30 years is Rs. The calculator also tells you about your home loan EMIs and total principal amount.

Since the most recent low point in May new loans have climbed by 207 per cent with loans to owner-occupiers up by 228 per cent over the same period. The total value of home loan approvals jumped by 44 per cent in December to be 14 per cent higher over the year. Now is the time to borrow.

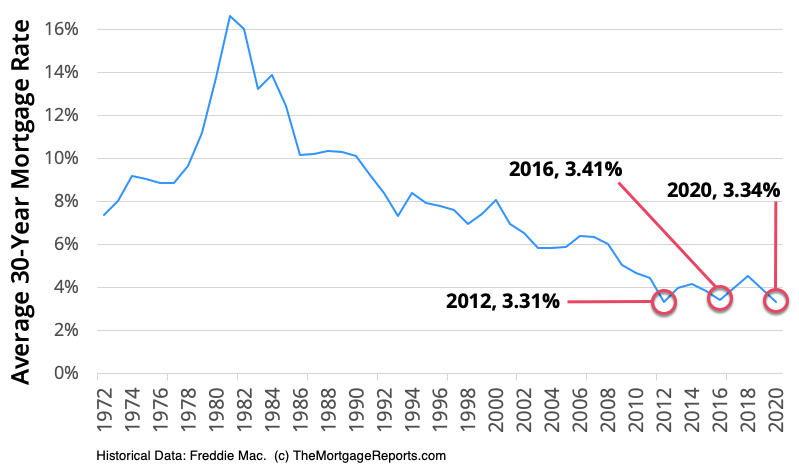

With 30-year fixed rates dipping below 27 in 2020 even a steep increase of 1 would leave rates well short of the 5 to 6 average rates we saw just 15 years ago. You can know your total home loan interest payout by using a home loan EMI calculator. That means its best to shop todays mortgage rates now while mortgage rates are still historically low.

This year interest rates are expected to stay around 38 according to Freddie Mac. To put it into perspective the monthly payment for a 100000 loan at the historical peak rate of 1863 in 1981 was 155858 compared to 43851 at the historical low rate of 331 in 2012. National Average Mortgage Rates.

The average 51 ARM rate is 3368 up 0143 from yesterday. With a 51 ARM the interest rate your loan comes with stays in effect for five years after which it adjusts once a year. The average interest rate on the 15-year fixed mortgage is 254 jumping 8 basis points from 246 over the last week.