The national average credit card APR was 1465 in November 2020 according to a January 2021 report from the Federal Reserve. Credit card rates have been trending upward over the past few years.

What Is Apr Understanding How Apr Is Calculated Apr Types

The median credit card interest rate for all credit cards in the Investopedia database currently stands at 1962 based on average advertised rates across several hundred of the most popular card.

What is a normal apr for a credit card. The average credit card APR isnt necessarily reflective of the APR youll receive on a credit card youre approved for though. All lenders have to tell you what their APR is before you sign a credit agreement. Unstable conditions can cause the APR to bear little resemblance to what the EAR will be by the end of a fiscal year.

The difference between unsecured cards and secured cards is similar to the variations by credit score. The right 0 credit card could help you avoid interest entirely on big-ticket purchases or reduce the cost of existing debt. Credit card APRs change as federal interest rates change.

A credit cards APR is an estimate of what the interest rate is or will be in the near future. Ad Get a Card with 0 APR Until 2022. According to the Federal Reserves data for the third quarter of 2020 the average APR across all credit card accounts was 1458.

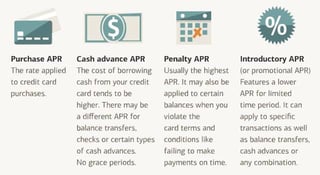

If youve ever shopped for a loan or gotten a credit card youve seen the term APR or annual percentage rate all over financial websites and your account statements. Introductory APR Some credit cards come with a temporary interest rate referred to as promotional or introductory APRs. APR is an annualized representation of your interest rate.

It takes into account the interest rate and additional charges of a credit offer. A good APR for a credit card is 14 and below. Note however each credit card has multiple APRs.

As of November 2020 the average APR charged for credit card accounts that incurred interest was 1628 according to the Federal Reserve. How its applied and how its calculated. Our Experts Found the Best Credit Card Offers for You.

These short-term rates can be as low as 0 and usually last between six and 18 months from when you first open the account. Purchase and balance transfer APRs are usually. Given stable conditions the APR is at best a partial reflection of the Effective Annual Rate EAR but this is not always the case.

On accounts assessing interest the average was 1628. You may pay a different APR on cash advances and balance transfers for example and also after missing a payment known as a penalty APR. The average APR for an unsecured credit card is currently 2529.

Some credit cards offer an introductory APR which is typically 0 and can apply to purchases balance transfers or both for an introductory period. The average APR for a secured credit card is currently 181. When deciding between credit cards APR can help you compare how expensive a transaction will be on each one.

The term APR stands for annual percentage rate which is the rate lenders charge when you borrow money. Secured Credit Cards. Annual percentage rate APR is the official rate used to help you understand the cost of borrowing.

Ad Get a Card with 0 APR Until 2022. Its helpful to consider two main things about how APR works. Our Experts Found the Best Credit Card Offers for You.

After that time frame the regular purchase APR will go into effect. The average credit card interest rate is 1615. How does APR work.

For the second week in a row the national average card APR remained at its highest point in just over a year. And a great APR for a credit card is 0. The APR youre charged for a credit card mortgage or personal loan is primarily based on your credit rating and income.

Thats roughly the average APR among credit card offers for people with excellent credit. It represents the yearly cost of funds but it can be applied to loans made for much shorter periods of time. According to the Federal Reserve the average rate for credit card accounts that assessed interest was 1661 at the end of the.

How Your Credit Card APR Is Determined. If you pay off your balance in full every month you may never have to pay APR on your credit card.

:max_bytes(150000):strip_icc()/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

:max_bytes(150000):strip_icc()/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)