For example if your credit card interest rate is 1299 percent per year your daily rate is 0356 percent. What percentage of your credit card limit should you use duplicate Ask Question Asked 8 years 11 months ago.

Most experts recommend keeping your overall credit card utilization below 30.

:max_bytes(150000):strip_icc()/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

What percentage of your credit card should you use. However your credit score should improve if. When it comes to paying off your credit card try to pay the most you can. If you have a balance of 2500 on one card and a 0 balance on the other your total balance is 2500 and your credit utilization ratio is 25.

Your credit card company gives you a credit limit you can make purchases against. But theres really no magical utilization rate cutoff for every scoring model. This question already has answers here.

Viewed 3k times 0. What is the optimal ratio of used credit to credit limit for your credit. If you want to improve and maintain a good credit score its more reasonable to keep your balance at or below 30 of your credit limit.

You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit. Its commonly said that you should aim to use less than 30 of your available credit and thats a good rule to follow. Try not to exceed 25 of your credit line if you can because whatever you owe on the card at the end of the montheven if you pay it off in fullis divided by your available credit limit to get a utilization ratio.

Ive been told by numerous experts that consumers should have a credit utilization rate of no more than 30 percent. Experts generally recommend keeping your utilization rate below 30 depending on the scoring system used but CNBC Select spoke to two credit gurus who say to aim for a single-digit. Some credit experts say you should keep your credit utilization ratio the percentage of your total available credit you use below 30 to maintain a good or excellent credit score.

Otherwise make at least a minimum payment. FICO has noted that below 20 is good below 10 is better and that people who have the highest credit scores average 7 credit utilization. The resulting percentage is a component used by most of the credit-scoring models because its often correlated with lending risk.

Say you have two credit cards each with a limit of 5000 making your total credit limit 10000. But the lower the better. Theres no absolute best amount of credit to use to help improve your credit scores but keeping your total utilization ratio and the ratios for each of your credit cards below about 30 will prevent serious reductions in credit score and promote score improvement.

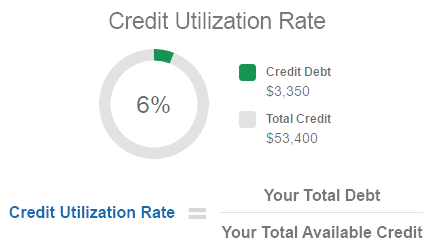

This limit will be based on things like your credit score income and account history. For example that means your credit card balance should always be below 300 on a credit card with a 1000 limit. You can figure out your credit utilization rate by dividing your total credit card balances by your total credit card limits.

While there are no hard-and-fast rules around what an ideal utilization ratio should be below 30 percent is typically recommended. On the other end of the spectrum having a zero percent credit. Calculate your daily interest rate by dividing your yearly annual interest rate by 365.

Active 8 years 11 months ago. As you charge purchases. Shown as a percentage it represents how much credit you use your credit card balance compared to how much you have available to you your credit limit.

In general it is recommended that you use up to 20 of your credit limit. Closed 8 years ago. So for example if your credit card limit was 1000 you should keep your.

According to Experian one of the three major credit bureaus the average credit utilization ratio for a person with a credit score over 800 is 115. So if you have an 800 credit card. Having a lower credit utilization rate implies that you are not likely to default on your credit payments.

Your credit utilization ratio the amount you owe versus your total available credit comprises 30 percent of your credit score and is the second most important factor after on-time bill payments. For optimum credit score results the balances on your credit cards both individually and combined together should be as low as possible.

6 Simple Steps To Improve Your Credit Score

6 Simple Steps To Improve Your Credit Score

/how-having-a-zero-balance-affects-your-credit-score-960530-v1-114f260e205b479ca394b027e1525721.jpg) How Having A Zero Balance Affects Your Credit Score

How Having A Zero Balance Affects Your Credit Score

Pros And Cons Of Using A Personal Loan To Pay Off Credit Card Debt Forbes Advisor

Pros And Cons Of Using A Personal Loan To Pay Off Credit Card Debt Forbes Advisor

How Does The Credit Utilization Percentage Impact My Credit Score

How Does The Credit Utilization Percentage Impact My Credit Score

6 Common Credit Terms You Should Know Central Bank

6 Common Credit Terms You Should Know Central Bank

Max Our Credit Card Limits And Hurt Your Credit Learn Why Credit Com

30 Credit Utilization Rule Truth Or Myth Nerdwallet

30 Credit Utilization Rule Truth Or Myth Nerdwallet

How Having Multiple Credit Cards Affects Your Credit Score

How Having Multiple Credit Cards Affects Your Credit Score

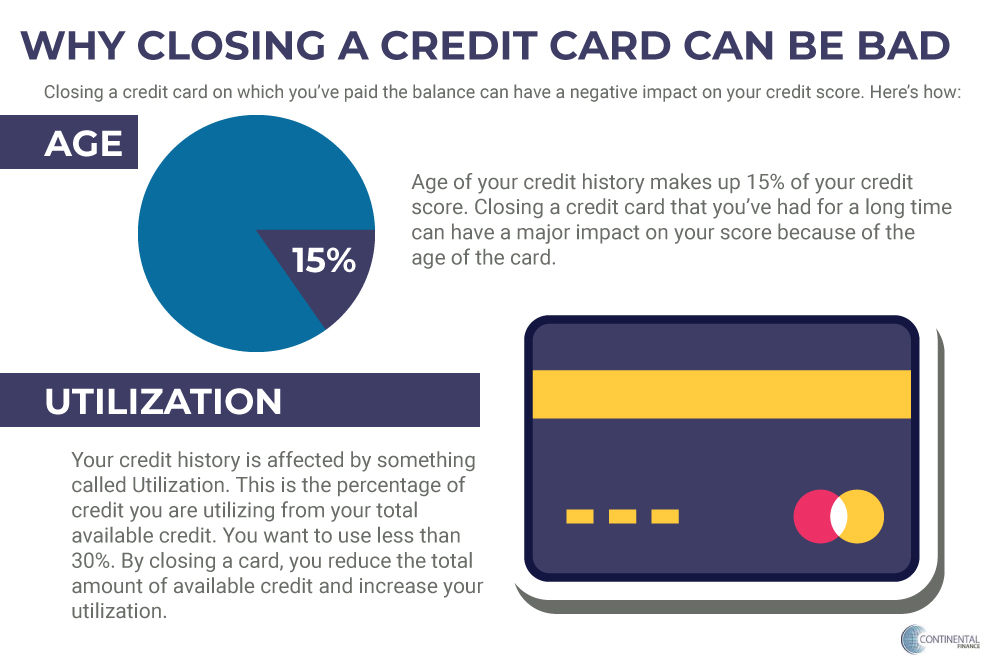

Is Closing A Paid Off Credit Card Account Good Or Bad

Is Closing A Paid Off Credit Card Account Good Or Bad

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

![]() What Is A Credit Utilization Ratio Mybanktracker

What Is A Credit Utilization Ratio Mybanktracker

How Does The Credit Utilization Percentage Impact My Credit Score

How Does The Credit Utilization Percentage Impact My Credit Score

What Is A Credit Utilization Rate Experian

What Is A Credit Utilization Rate Experian

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.